As a job manager or chief appraiser at a bank

As a job manager or chief appraiser at a bank, appraisal workflow can be handled by Outlook/Excel, outsourced to AMCs or third-party workflow platforms. Sometimes when we’re talking with prospects about our workflow platform YouConnect we hear, “Yeah, we’re good” and “If it’s not broke, don’t fix it.” Understandably, you’re busy. Very busy. There’s little time to calculate the true cost of the wrong platform. What’s at stake; a potential significant loss of staff time, money (underperforming partner of the lending department) and eroding competitive effectiveness.

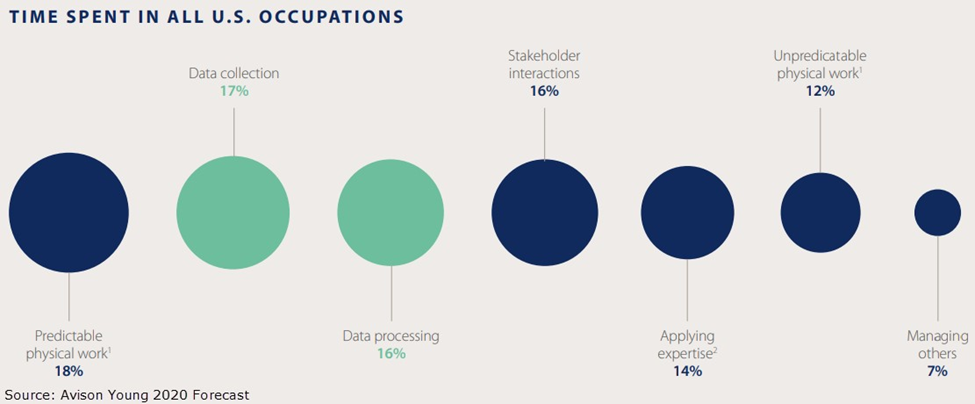

Based on the Avison Young 2020 Forecast chart, I would extrapolate (albeit across all occupations) that daily tasks for job managers would include data collection, data processing and applying expertise or 47% of their day. Assuming a job manager makes $70,000 per year, this equates to $32,900 in labor. Assume a chief appraiser makes $125,000 per year with their tasks to include data collection, stakeholder interactions, applying expertise and managing others that total 54% or $67,500 of effort.

For the above two employee’s example, the total annual labor investment associated with ordering appraisals is $100,000 rounded. Our math includes staff appraisers, reviewers and support. This “back of the napkin” discussion highlights the impact of an effective appraisal workflow platform to create a cohesive, finely-tuned appraisal department.

If one digs deeper, custom reporting, ongoing new feature development and comp data are the critical differential. If your workflow provider takes months (if not years) to roadmap new features, it’s often too late. Internal processes may have changed, bank acquisitions brought in new players or a different management culture. Avison Young’s US report states that in 2020; “U.S. consumers and businesses will continue to operate with cautious optimism, with global uncertainty persisting…” Maybe it’s a great time to re-evaluate if